Canadian debt levels are among the highest of developed

country nations, beyond those of Americans and Britons. Recently, we’ve been warned that these debt

levels are far

worse than previously thought with growing consensus among experts that

Canadians aren’t immune from the downfall they witnessed among their American

neighbors. The only

bright side, ironically, tends

to be the eroding asset base of Canadians, which is largely dependent on a deteriorating housing market. As Madani at Capital Economics explained: “Debt growth dynamics over the last decade look eerily

similar to the U.S. experience, just before their dramatic housing bust.”

In response, the discussion in the media tends to revolve

around the dilemma the Bank of Canada faces in its efforts to combat a

struggling global economy on the one hand, which requires a lowering of

interest rates, and rising household debt levels on the other, which

paradoxically requires the raising of interest rates. I find our reliance on the Bank of Canada

amusing because nowhere in our discussion of this dilemma are we considering

what I think is the elephant in the room, which I refer to as an intrinsic

motivation of big banks to exploit consumers.

3 Types of Lending

To understand this, it’s worthwhile to perhaps

simplistically distinguish among three types of lending practices. The first is responsible lending where banks

respond to the needs and wants of informed and educated consumers as a means to

lubricate the economy to improve societal welfare, The second is called

careless lending, an extreme level of lending that we saw in the US where, due

to the deferral of risk, lenders provide credit to those highly susceptible to

default. The conversation in Canada often

ends here as loyalists to the invisible hand argue that banks have no incentive

to employ the latter practice because our regulation makes it so that consumer

default results in bank losses. In fact,

recently, National Bank Financial analysis Peter Routledge explained

“That these consumer

debt levels are a non issue because the average loss rates on banks’ credit

cards has fallen back down to about 4 percent, a level not seen since 2008 and

the average value accounts whose payments are 90 days or more delinquent is

just 1 per cent of the portfolio.”

He concludes that while Canadian debt levels are high, the

default rates clearly indicate that this is a non-issue. The fascinating thing about this absurd and

completely misguided conclusion and others

that say debt levels isn’t a big deal is that he’s using defaults as a

proxy for debt problems rather than considering the idea that perhaps banks

have just gotten better at finding ways to exploit consumers without sustaining

the cost of default.

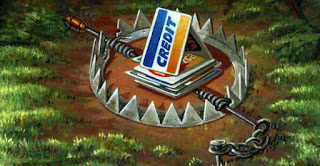

This leads me to an overlooked third category of lending

practices that I think represents a majority of the types of loans banks make

called exploitative lending, a middle ground between the first two extremes

where banks search for gaps in consumer knowledge to impose on them the maximum

amount of credit possible without them defaulting. It is this third type of lending that while

difficult to pin down is critical because it puts into clear focus the inherent

conflict between bank and societal interests, a conflict that I believe is

responsible for today’s debt levels. A recent report from an equity research firm in Toronto looking into the ease at which consumers can get mortgages found that banks are bending over backwards to make it easy to take the plunge and buy. It noted: "At once sales centre, BMO was willing to lend half of the required 20 per cent down payment. Apparently, BMO is qualifying the prospective borrower on the full mortgage before approving the down-payment loan".

My Own Experience

For the last several years, I’ve been bombarded with offers

from my and other banks to take advantage of credit opportunities, to increase

the credit limit on my personal line of credit, my visa card, or to apply for a

home secured personal line of credit.

The latter came up when I was asking for a $5000 increase in the credit

limit of my existing PLC, at which time I was encouraged to apply for a home

secured line of credit that would provide me with 40 times the amount I was

originally asking for and 8 times what I had already. The interesting

point of the conversation was that the person on the phone forgot completely

about my original request of $5000. On top of all this, I

recently received my fourth communication in a year from my bank offering a 33%

increasing in my visa credit despite the fact that since first getting a visa

card 17 years ago I have never come close to having a balance of more than 33%

of my credit limit for more than 4 weeks.

In other words, I have never maintained a balance on my visa card.

Now what is going on here?

Is my bank really looking out for my needs by offering credit to me that

is going to improve my life? Sadly, I

don’t think banks are experts at improving the quality of life of their

consumers. They are experts at finding

ways in which to capture value from their consumers. In this case, value comes in the form of disposable

income. In my case, the bank has learned

through reams of data on people sharing my demographic and psychographic characteristics that

increasing my credit limit in multiple ways leads to a false sense of security

that I have greater disposable income through which to meet needs I didn't know I had. More specifically, they know that because I’m

comfortable with a 33% use of my credit limit and that my income level has not

increased by a similar amount, increasing that credit limit will eventually lead to

payments that exceed my monthly income thereby locking me into a perpetual

state of interest payments and a high debt-income ratio. To ease consumers into what it means to have a large balance on their PLC, banks require that consumers keep a minimum balance on new PLCs as a means to avoid initial registration fees. After the 3 months of a high balance, the hope is that the consumer is accustomed to such a debt level while at the same time hasn't put money away to pay this off.

Throughout my undergraduate university education, I worked

at one of these financial institutions as a customer service representative

(teller). I was awarded cash on the spot

if I signed up someone for a credit card.

We were very strongly encouraged to look at the birthdates of younger looking

clients to see if they were 18 and were now eligible for a credit card. I recall learning clever tactics to convince

them to get a card such as benefits to their credit rating for future credit

access and the benefits of receiving free money for up to a six-week

period. I realize today that this

represents a dramatically scaled-down version of a more general culture of

pushing credit on unbeknownst consumers.

From the bankers’ perspective, think about how easy it would

be to slide down the slippery slope of exploitative lending by finding ways to

convince consumers to take on more credit that they don’t need. Bankers are very bright people, and while

well intentioned at best, they understand the psychology behind consumer

purchase decisions. They know that a

majority of the consumer population struggles to differentiate between cash and

credit and that when consumers see a high credit limit they are more willing to

use that credit in lieu of cash. If you

were a bank, you would have every motivation to push credit on consumers just

up to the point prior to bankruptcy. Call

it greed or good business, the point is that this is a reality that we’re not

talking about.

Consumer Responsibility

One of the main reasons why this discussion hasn’t yet occurred

is because the very conservative Canadian culture would argue that it’s up to

Canadian consumers to spend responsibly and therefore to borrow responsibly. Carney himself, in his message to Canadians,

tends to use this approach. What this

completely overlooks however is how the power of Canadian financial

institutions in influencing consumer behaviour in Canada.

Several months back I was somewhat lambasted by the

Sustainability Director of one of the Canadian banks because I criticized their

green initiatives as green washing, a mere disguise for the blatant disregard

that they oftentimes demonstrate to society.

My main criticism, like with many other firms I comment on, is that on

the one hand the bank is marketing the hell out of their commitment to

renewable energy and energy efficiency in their retail branches but on the

other ignores how their ongoing daily activities with business

and individual consumers leaves them culpable to debt issues.

There is no question that the banks would respond to my

above claims by completely denying responsibility for any increase in debt

levels because it is up to the consumer to make sound credit decisions. This is an expected response, one that

several other industries have taken when they engage in activities that

indirectly lead to major social issues. The

apparel industry denied responsibility for sweatshop labour in the 1990s, the

consumer electronics industry, up to a year ago, denied responsibility for the

suicides in their suppliers’ factories, the food and beverage industry denied

responsibility for the obesity epidemic, and of course the tobacco industry

denied responsibility for consumer deaths.

The banks got their first scare in 2008 with the financial

crisis revealing that the inherent motivation of the financial industry does

not necessarily align with society’s interests.

As Canadians figure out that debt levels, like cigarette addiction

rates, are not necessarily caused by consumer irresponsibility but rather a

blatant attempt by banks to exploit the vulnerabilities of their consumers, a

major backlash will ensue…perhaps one so drastic that they end up like their

tobacco company counterparts, cowering in a corner begging for mercy.